UPI vs AllyPay – Which is Safer for Your Money?

UPI vs AllyPay – Which is Safer for Your Money?

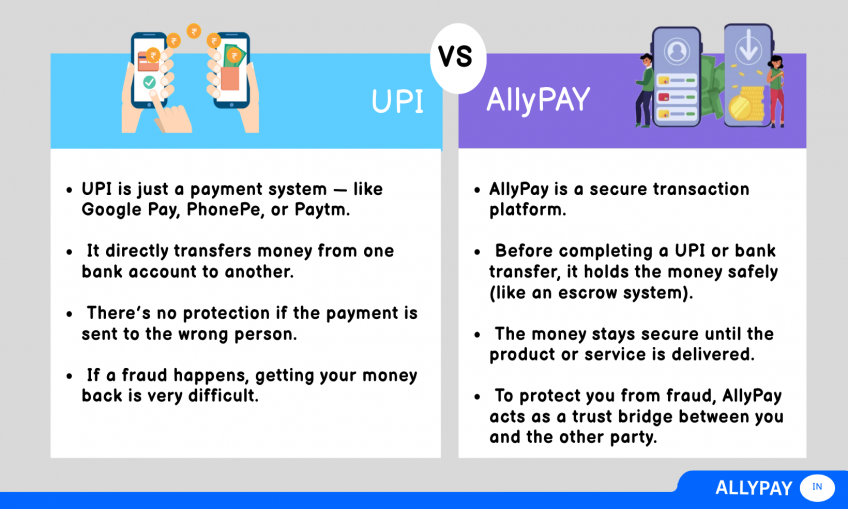

🔹 What is UPI?

UPI (Unified Payments Interface) is a fast and convenient payment method used by apps like Google Pay, PhonePe, and Paytm.

But it has no security layer once the money is sent — if you transfer funds to the wrong person or get scammed, recovering money is very difficult.

❌ No refund protection

❌ No fraud safety

✅ Fast direct payment

🔹 What is AllyPay?

AllyPay adds a layer of security to your payment.

Before transferring money through UPI or bank, AllyPay holds the funds securely (like an escrow).

The money is released only after the product or service is delivered.

This helps build trust and avoid fraud.

✅ Safe money hold

✅ Released after delivery

✅ Fraud protection

✅ Dispute help

Create or include a side-by-side infographic with:

| Feature | UPI | AllyPay |

|---|---|---|

| Direct Payment | ✅ Yes | 🚫 No (Held Securely) |

| Refund Protection | ❌ No | ✅ Yes |

| Fraud Safety | ❌ Low | ✅ High |

| Dispute Support | ❌ No | ✅ Yes |

| Trust Layer | ❌ No | ✅ Yes |